05 Nov Forex Trading A Comprehensive Guide to the Foreign Exchange Market 1854352860

Forex trading, also known as foreign exchange trading, is the act of buying and selling currencies in a global decentralized market. This dynamic market allows individuals, institutions, and governments to exchange currencies, making it one of the largest financial markets in the world. With a daily trading volume exceeding $6 trillion, the Forex market offers extensive opportunities for traders. In this guide, we will delve into various aspects of Forex trading, including key concepts, strategies, risks, and the importance of staying informed. For those looking to deepen their understanding, resources like forex trading foreign exchange market https://trading-asia.com/ can be instrumental in gaining insights and honing trading skills.

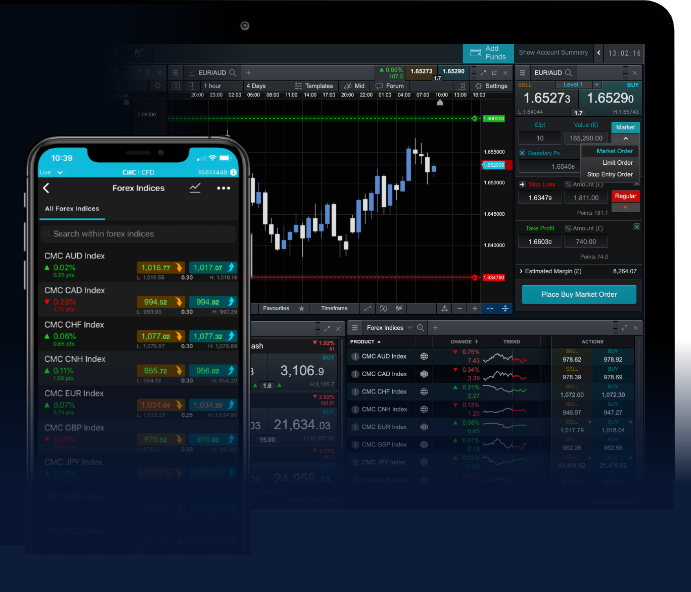

Understanding the Forex Market

The Forex market operates 24 hours a day, starting from Sunday evening until Friday night, making it unique among financial markets. This market isn’t centralized; instead, it operates through an over-the-counter (OTC) network of banks, brokers, and individual traders. Transactions occur in pairs, with the value of one currency being quoted against another, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen).

Currency Pairs

In Forex trading, currencies are categorized into three main groups: major pairs, minor pairs, and exotic pairs. Major pairs include the most traded currencies such as the US dollar, Euro, and Japanese Yen. Minor pairs involve currencies that are not related to the US dollar but are still commonly traded, like the Euro and British Pound. Exotic pairs, on the other hand, comprise a major currency paired with the currency of a developing economy, which can offer higher risk and reward due to lower liquidity and volatility.

How Forex Trading Works

Forex trading involves speculation on the price movement of currency pairs. Traders aim to predict whether a currency’s value will rise or fall in relation to another currency. When a trader believes that a currency pair will rise, they “buy” (go long); conversely, if they think the pair will fall, they “sell” (go short). This speculation can be influenced by various factors, including economic indicators, political stability, interest rates, and market sentiment.

Market Participants

The Forex market comprises various participants, each with distinct motivations:

- Banks and Financial Institutions: The primary players in the Forex market, handling large volumes of currency transactions.

- Corporations: Companies involved in international trade often engage in Forex to hedge against currency fluctuations.

- Retail Traders: Individual traders who participate in the Forex market seeking profit from the small price movements in currency pairs.

- Central Banks: Institutions that influence their domestic currencies’ value through monetary policy and market interventions.

Forex Trading Strategies

Successful Forex traders leverage various strategies to maximize their potential for profit:

- Technical Analysis: Traders analyze historical price data and chart patterns to advocate future movements.

- Fundamental Analysis: This involves assessing economic indicators, news events, and other fundamental factors affecting currency values.

- Scalping: A short-term strategy aiming for small price changes, requiring a trader to make multiple transactions throughout the day.

- Day Trading: Involves holding positions for a single trading day, closing all trades by the market close to avoid overnight risk.

- Swing Trading: A medium-term strategy where traders hold positions for several days or weeks, capitalizing on expected upward or downward market shifts.

Risks in Forex Trading

While Forex trading offers substantial rewards, it also carries significant risks:

- Market Risk: The risk of loss due to unfavorable price movement.

- Leverage Risk: Forex trading allows traders to control large positions with relatively small amounts of capital; however, this increases both potential gains and potential losses.

- Liquidity Risk: In times of low market activity, a trader may not be able to execute a trade at the desired price.

- Psychological Risk: Emotional decision-making can lead to impulsive trading, which can result in losses.

The Importance of Education and Research

Staying informed and continuously learning is essential for success in Forex trading. New traders should begin with foundational concepts and gradually progress to more advanced strategies. Using demo accounts for practice can help traders familiarize themselves with different trading platforms and strategies without risking real money. Additionally, engaging with community forums, following economic news, and subscribing to analyses from experienced traders can enhance knowledge and skills.

Conclusion

Forex trading is a complex yet rewarding venture that requires a solid understanding of the market dynamics, analytical skills, and risk management strategies. As you embark on this trading journey, approach it with a mindset focused on learning and adapting. Remember that every trader’s experience varies, and maintaining a disciplined trading plan is crucial for long-term success. Resources such as https://trading-asia.com/ can provide invaluable insights and guidance as you navigate the world of Forex trading. Stay committed to your education, and gradually develop your trading skills to capitalize on the vast opportunities the Forex market has to offer.

No Comments