13 Nov Chart of Accounts: Essential Guide for Business Success

A well-maintained chart provides clear insights into financial health, enabling entrepreneurs to make informed decisions that drive expansion. Accurate financial data is also crucial for identifying growth opportunities, such as when to invest in new projects or expand market reach. Naming your accounts prevents confusion about the transaction, thus making it easier to provide accurate financial report insights. It becomes important to the chart of accounts as the information provided results in an accurate listing of all accounts and related revenues and expenses.

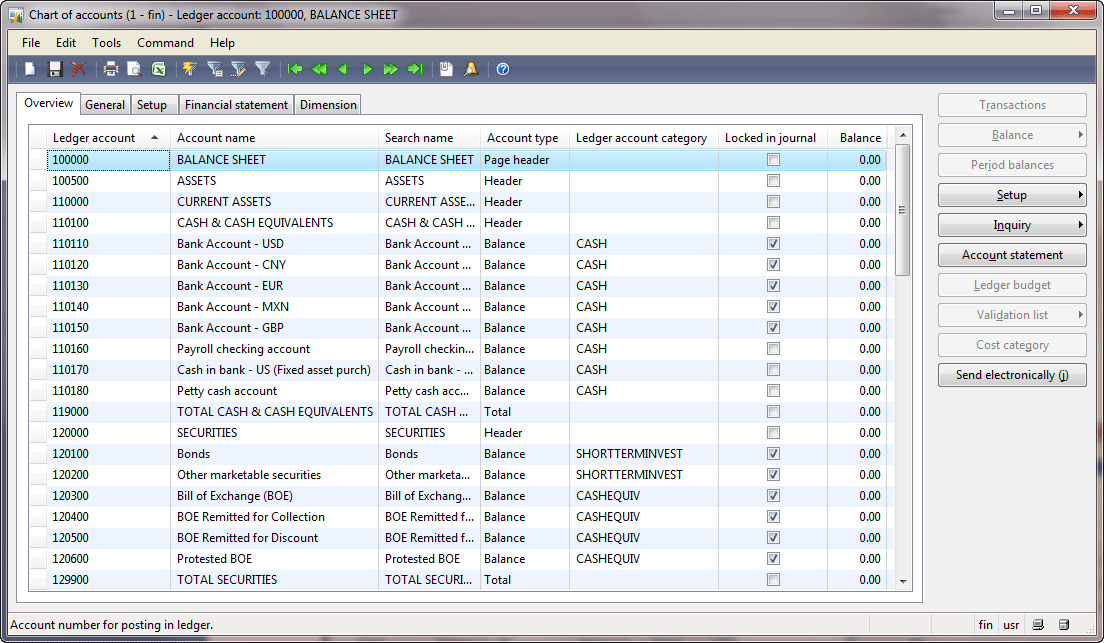

Setting Up COA in Software

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Reason #1: Gain clarity on a company level

The chart of accounts in SAP S/4HANA Cloud is flexibly designed, a significant advantage. By customizing and regularly updating their chart of accounts, organizations ensure that it evolves in sync with their business. This enables organizations to maintain accurate and comprehensive financial reporting. In the ever-changing world of business, it’s crucial for companies to regularly update their chart of accounts (COA) to align with evolving business needs. This could involve adding new General Ledger accounts, modifying existing account attributes, or adjusting or creating new financial statement versions (FSVs).

- In addition to these ratios, vertical analysis or common-size analysis can be performed on the income statement by expressing each line item as a percentage of revenue.

- Revenue is the amount of money your business brings in by selling its products or services to clients.

- The chart of accounts (COA) is a listing of all accounts that appear in an accounting system’s general ledger for a business.

- This is important because a chart of accounts can include many different line items—sometimes even hundreds in just one primary account.

- They need to be mindful of the Generally Accepted Accounting Principles and the Financial Accounting Standards Board, however.

What are the main differences between a chart of accounts and a balance sheet?

This capability is crucial for maintaining the accuracy of the COA, as it ensures that all entries are correct and accounted for, minimizing discrepancies and errors that can arise from manual entry. The Reconciliation Control Tower provides a comprehensive overview of the reconciliation status of all accounts within the COA. By offering real-time visibility into variances and discrepancies, this tool helps finance teams quickly identify and address issues, ensuring that the COA reflects accurate and current financial data. Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement. For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts.

To ensure an efficient COA structure, it is crucial to establish a consistent and standardized coding system for account numbering and naming conventions. This will enhance the readability and usability of financial reports across all departments and divisions. Next, I’ll show you how the chart of accounts is a part of the financial statement building process.

Helpful resources for small businesses:

For ease of use, a COA contains the list of accounts’ names, brief descriptions, account type, account balance and account codes for each sub-account. Just remember that while you can add an account to the chart at any time throughout the financial year, you should not delete any accounts until the end of an accounting period. Therefore, it is advisable to initially create a list of accounts that is unlikely to significantly change for as long as possible and keep it congruent among all areas of business. If you start off with only a handful of accounts and then keep expanding the list as your business grows, it may become increasingly challenging to compare financial results against the previous years. On the other hand, organizing the chart with a higher level of detail from the beginning allows for more flexibility in categorizing financial transactions and more consistent historical comparisons over time.

Yes, it is a good idea to customize your chart of accounts to suit your unique business. The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types. It also lays the foundation for all your business’s important financial reports.

This significantly aids organization in financial analysis, compliance, and decision-making. When setting up a chart of accounts, it’s important to establish a consistent and logical account numbering system. This numbering system, or coding system, assigns an identification code to each account, making it easier to locate and track different transactions. Generally, account numbers consist of digits that represent the various account categories and subcategories. In summary, a well-designed Chart of Accounts is crucial to an organization’s financial success.

A chart of accounts will likely be as large and as complex as a company itself. An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts. Nevertheless, the exact structure of the chart of accounts is the reflection on the individual needs of each entity. There are a few things that you should move from excel to accounting software keep in mind when you are building a chart of accounts for your business. Find out more about how QuickBooks Online can help you save time and stay on top of your finances while you grow your business. As time goes by, you may find yourself wanting to create a new line item for each transaction, but doing so could litter your company’s chart and make it difficult to navigate.

For example, if a company makes a sale, it debits an asset account (like Accounts Receivable or Cash) and credits a revenue account (Sales Revenue), as defined in the COA. The company records each transaction (journal entry or accounting entry) in the general ledger account, and the general ledger totals create the trial balances. The relationship between journal entries and the chart of accounts is akin to the relationship between a script and its cast of characters. The COA serves as the cast—a structured list of all accounts where financial transactions can be recorded.

Journal entries, on the other hand, are the script— the actual recording of financial transactions as they occur. A chart of accounts (COA) is a structured list of an organization’s financial accounts used to categorize and record financial transactions. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner. The COA is tailored to an organization’s needs and can vary widely in complexity. Similar to a chart of accounts, an accounting template can give you a clear picture of your business’s financial information at a glance.

No Comments