25 Jan How to Prepare a Cash Flow Statement

They’ll make sure everything adds up, so your cash flow statement always gives you an accurate picture of your company’s financial health. When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow. It’s important to remember that long-term, negative cash flow isn’t always a bad thing. For example, early stage businesses need to track their burn rate as they try to become profitable. What it doesn’t show is revenue or expenses, or any of the business’s other cash activities that impact your company’s day-to-day health. The most common method of preparing the statement of cash flows.

Determine the Starting Balance

Here is a tip on how I keep track of what transactions go in each cash flow section. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information.

Free Course: Understanding Financial Statements

This information is helpful so that management can make decisions on where to cut costs. It also helps investors and creditors assess the financial health of the company. This cash flow statement shows that Nike started the year with approximately $8.3 million in cash and equivalents. Figures used in this method are presented in a straightforward manner. They can be calculated using the beginning and ending balances of various asset and liability accounts and assessing their net decrease or increase. Analysts look in this section to see if there are any changes in capital expenditures (CapEx).

How to track cash flow using the indirect method

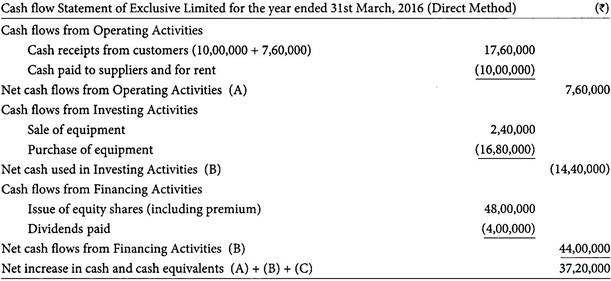

This is because terms of sales and purchases may differ from company to company. Management can use the information in the statement to decide when to invest or pay off debts because it shows how much cash is available at any given time. Cash-out transactions in CFF happen when dividends are paid, while cash-in transactions occur when the capital is raised. Transactions in CFF typically involve debt, equity, dividends, and stock repurchases. Together, these different sections can help investors and analysts determine the value of a company as a whole.

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Let’s take a closer look at what cash flow statements do for your business, and why they’re so important. Then, we’ll walk through an example cash flow statement, and show you how to create your own using a template.

Book a demo with our friendly team of experts

For each, identify whether thetransaction represents a source of cash (S), a use of cash (U), orneither (N). LO 16.2Describe three examples of financingactivities, and identify whether each of them represents cashcollected or cash spent. LO 16.2Describe three examples of investingactivities, and identify whether each of them represents cashcollected or cash spent. LO 16.2Describe three examples of operatingactivities, and identify whether each of them represents cashcollected or cash spent. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out. Consequently, the business ended the year with a positive cash flow of $1.5 million and total cash of $9.88 million. Notes payable is recorded as a $7,500 liability on the balance sheet. Since we received proceeds what’s the advantage of turbotax advantage from the loan, we record it as a $7,500 increase to cash on hand. A balance sheet shows you your business’s assets, liabilities, and owner’s equity at a specific moment in time—typically at the end of a quarter or a year. Only the cash related to the long-term asset or long-term liability is reported in the investing and financing section.

Cash flows from operating activities include transactions from the operations of the business. In other words, the operating section represent the cash collected from the primary revenue generating activities of the business like sales and service income. Operating activities are short-term and only affect the current period. For example, payment of supplies is an operating activity because it relates to the company operations and is expected to be used in the current period. LO 16.4Use the following excerpts from OpenAirCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018. LO 16.4Use the following excerpts from MountainCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018.

- More than 95% of all company’s report using the indirect cash flow statement.

- It’s important to remember that long-term, negative cash flow isn’t always a bad thing.

- If you’re wondering how to make a cash flow statement, these steps can guide you through the process, from gathering initial data to calculating the final cash balance.

- Along with income statements and balance sheets, cash flow statements provide crucial financial data that informs organizational decision-making.

Our easy online enrollment form is free, and no special documentation is required. No, all of our programs are 100 percent online, and available to participants regardless of their location. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. Long Term Debt increased this year, therefore, the company borrowed money.

No Comments