29 Oct Learn Forex Trading A Comprehensive Guide for Beginners 1830661000

Learn Forex Trading: A Comprehensive Guide for Beginners

Forex trading, or foreign exchange trading, is the process of buying and selling currencies with the aim of earning profit. As the largest financial market globally, it offers immense opportunities for traders at all levels. Whether you’re a complete novice or have some experience, this guide will help you understand the fundamentals of forex trading and how to get started with learn forex trading Trading Broker ZA.

Understanding the Forex Market

The forex market is a decentralized marketplace, operating 24 hours a day, five days a week. This market facilitates currency exchange, which is essential for international trade and investment. Unlike stock markets, the forex market does not have a physical location; instead, it exists electronically, with traders interacting through online platforms.

Key Players in the Forex Market

Several key players participate in the forex market, including:

- Central Banks: These institutions manage a country’s currency, money supply, and interest rates, playing a vital role in economic stability.

- Commercial Banks: Large banks trade currencies in substantial volumes, facilitating currency exchange for clients and conducting proprietary trading.

- Hedge Funds and Investment Firms: These entities speculate on currency movements to earn profits, often utilizing advanced strategies and technologies.

- Retail Traders: Individual traders participate in the forex market through online brokerages, seeking to profit from currency fluctuations.

The Basics of Forex Trading

Before diving into trading, it’s essential to familiarize yourself with some fundamental concepts:

Currency Pairs

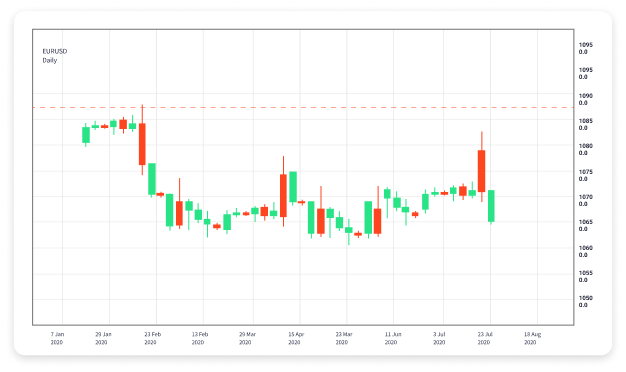

Forex trading involves trading currency pairs. Each pair consists of two currencies, with one being the base currency and the other the quote currency. The price of a currency pair indicates how much of the quote currency is required to purchase one unit of the base currency. For example, in the EUR/USD pair, if the price is 1.20, it means 1 Euro is equal to 1.20 US Dollars.

Pips and Lots

A pip (percentage in point) is the smallest price move in a currency pair. Most pairs fluctuate to the fourth decimal place, with the exception of the Japanese Yen, which is quoted to the second decimal. A standard lot is 100,000 units of the base currency, but you can also trade in mini (10,000 units) and micro (1,000 units) lots to manage risk effectively.

Leverage and Margin

Leverage allows traders to control a larger position with a smaller amount of capital. For instance, with a leverage ratio of 100:1, you can control a $100,000 position with just $1,000. However, while leverage can amplify profits, it also increases the risk of significant losses.

Developing a Trading Strategy

A successful forex trader should have a well-defined trading strategy. Here are crucial components to consider:

Risk Management

Effective risk management is vital to long-term success in forex trading. Determine the amount of capital you are willing to risk on each trade and set stop-loss orders to limit potential losses. A good rule of thumb is to risk no more than 1-2% of your trading capital on a single trade.

Technical Analysis

Many traders rely on technical analysis to make informed trading decisions. This involves analyzing historical price charts and using various indicators to predict future price movements. Popular indicators include moving averages, Relative Strength Index (RSI), and Fibonacci retracements.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, news events, and geopolitical situations that can impact currency prices. Factors such as interest rates, employment data, and inflation rates are crucial for assessing a currency’s strength.

Choosing a Forex Broker

Your choice of forex broker significantly influences your trading experience. Here are some key factors to consider when selecting a broker:

- Regulation: Ensure that the broker is regulated by a reputable authority, which provides a level of assurance regarding the safety of your funds.

- Trading Platform: The trading platform should be user-friendly, reliable, and equipped with essential tools and features.

- Spreads and Commissions: Compare the spreads and commissions offered by different brokers to find the most cost-effective option.

- Customer Support: Choose a broker with responsive customer support to assist you with any issues that may arise.

Starting Your Forex Trading Journey

Once you’ve developed a trading strategy and selected a broker, it’s time to create a trading account and begin trading. Follow these steps:

Open a Trading Account

Open a demo account to practice your trading strategies without risking real money. This allows you to familiarize yourself with the trading platform and improve your skills before transitioning to a live account.

Deposit Funds

After gaining confidence with your demo account, deposit funds into your live trading account. Ensure that you use funds that you can afford to lose, as trading involves inherent risks.

Monitor and Adjust

Once you start trading, consistently monitor your trades and the overall market. Be prepared to adjust your strategy based on your performance and changing market conditions.

Continuous Learning and Improvement

Forex trading is a skill that requires continuous learning and adaptation. Stay informed about market trends, economic news, and new trading strategies. Consider joining trading communities where you can exchange ideas and gain insights from fellow traders.

Conclusion

Learning forex trading can be a rewarding journey, offering potential financial freedom and flexibility. By understanding the fundamentals, developing a solid strategy, and choosing the right broker, you can navigate the forex market with confidence. Remember that success in trading does not come overnight; persistence, practice, and a willingness to learn are key to becoming a proficient forex trader.

No Comments