31 Oct What is Forex Trading A Comprehensive Guide 1589657860

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the exchange of one currency for another in the global financial market. It is the largest and most liquid market in the world, with a daily trading volume exceeding $6 trillion. Investors, traders, and institutions engage in Forex trading for various reasons, including currency conversion, speculation, hedging, and arbitrage. To learn more about Forex trading, you can explore what is trading forex fx-trading-uz.com, which offers insights and resources for both novice and experienced traders.

Understanding the Basics of Forex Trading

The Forex market operates 24 hours a day, five days a week, allowing traders to buy, sell, and exchange currencies at any time. Unlike traditional stock markets, Forex trading takes place over-the-counter (OTC), meaning that transactions occur directly between participants rather than through a centralized exchange. Major trading centers include London, New York, Tokyo, and Sydney.

How Does Forex Trading Work?

Forex trading involves currency pairs, where one currency is quoted against another. For example, in the EUR/USD pair, the Euro is the base currency, and the U.S. Dollar is the quote currency. When you buy a pair, you are purchasing the base currency while selling the quote currency. Conversely, when you sell the pair, you are selling the base currency and buying the quote currency.

Currency Pairs

Currency pairs are categorized into three main types:

- Major Pairs: Pairs that include the U.S. Dollar (e.g., EUR/USD, USD/JPY).

- Minor Pairs: Pairs that do not include the U.S. Dollar but involve major currencies (e.g., EUR/GBP, AUD/NZD).

- Exotic Pairs: Pairs that involve a major currency and a currency from a developing economy (e.g., USD/TRY, EUR/ZAR).

Market Participants

The Forex market comprises a diverse range of participants, including:

- Central Banks: Institutions that manage a country’s currency and monetary policy.

- Commercial Banks: Financial institutions that facilitate currency transactions for clients.

- Hedge Funds and Investment Managers: Entities that trade currencies to increase returns or manage risks.

- Retail Traders: Individual traders who engage in Forex trading for personal investment.

Factors Influencing Forex Prices

Several factors can influence currency prices in the Forex market, including:

- Economic Indicators: Data such as GDP growth, employment rates, and inflation can affect currency strength.

- Interest Rates: Central bank decisions regarding interest rates can lead to currency appreciation or depreciation.

- Political Events: Elections, geopolitical tensions, and policy changes can impact investor sentiment.

- Market Sentiment: Traders’ perceptions and emotions can drive market trends and price movements.

Forex Trading Strategies

Successful Forex trading requires effective strategies. Here are some popular approaches:

- Day Trading: Involves opening and closing trades within the same day to capitalize on small price movements.

- Swing Trading: Traders hold positions for several days or weeks to profit from longer-term trends.

- Scalping: A strategy that involves making numerous trades throughout the day for small profits.

- Position Trading: Long-term strategy based on fundamental analysis, holding positions for weeks or months.

Risk Management in Forex Trading

Managing risk is crucial in Forex trading. Here are some strategies to consider:

- Setting Stop-Loss Orders: Automatically closes a trade at a predetermined price to limit potential losses.

- Diversification: Spread your capital across various currency pairs to mitigate risk.

- Using Leverage Wisely: While leverage can amplify profits, it can also magnify losses; use it with caution.

- Maintaining a Trading Journal: Track trades, strategies, and outcomes to improve decision-making over time.

Choosing a Forex Broker

Selecting the right Forex broker is essential for successful trading. Factors to consider include:

- Regulation: Ensure the broker is regulated by a reputable authority to protect your funds.

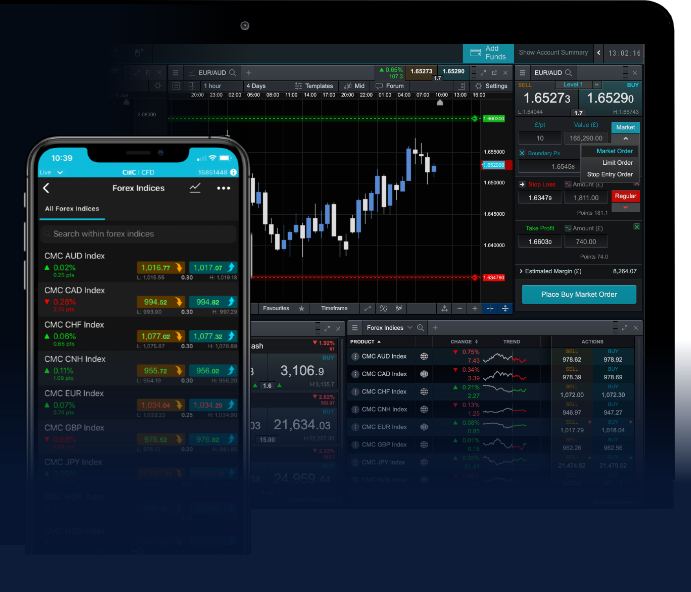

- Trading Platform: Evaluate the trading platform’s user interface, tools, and features.

- Spreads and Commissions: Compare transaction costs across brokers to find the most cost-effective option.

- Customer Support: Reliable customer service can help resolve issues quickly.

The Importance of Education in Forex Trading

Education is vital for anyone looking to succeed in Forex trading. Resources include:

- Online Courses: Structured courses can help beginners build a solid foundation in Forex trading.

- Webinars: Live sessions with experienced traders can provide insights and tips.

- Forex Books: Reading can expand your knowledge and introduce various trading strategies.

- Demo Accounts: Practicing with virtual trading platforms allows you to hone your skills without risking real money.

Conclusion

Forex trading offers vast opportunities for those willing to learn and refine their trading skills. Understanding the market, developing effective strategies, and managing risk are vital components of successful trading. With dedication, discipline, and the right education, traders can navigate this dynamic marketplace and potentially achieve their financial goals.

No Comments